Staged Government Terror: An Open Admission Within The British House of Lords link

The debt question was actually what prompted such an unbelievable admission of guilt by Lord James in the first place. Initially, he announced that he had been contacted by a very “strange” and secretive organization that wanted to “make a great deal of money available to assist the recovery of the economy” in England. After relaying this to a colleague in the House of Lords, Lord James was apparently told he was not important enough to be contacted by this organization, a statement which James evidently took personally. In response to his fellow Lord’s statement that he didn’t have the experience to deal with this agency, which is apparently secret to everyone except those deep in the Know, James’ response was remarkable.

“Yes I do,” he said. “I have had one of the biggest experiences in the laundering of terrorist money and funny money that anyone has had in the City. I have handled billions of pounds of terrorist money.”

When asked by the Baroness Hollis of Heigham where the money went to, he explained further:

Not into my pocket. My biggest terrorist client was the IRA and I am pleased to say that I managed to write off more than #1 billion of its money. I have also had extensive connections with North African terrorists, but that was of a far nastier nature, and I do not want to talk about that because it is still a security issue.James went even further after making these remarks, implicating the Bank of England in the funding of terrorists as well. “I hasten to add that it is no good getting the police in, because I shall immediately call the Bank of England as my defense witness, given that it put me in to deal with these problems.”

While the idea that the Bank of England, the House of Lords, and other governmental institutions fund the very terrorists they claim to be so afraid of is not surprising at all; it is only surprising to see such open discussion of it in public. Britain has devolved into a police state in recent years under the guise of fighting terrorism, yet their own governmental and banking institutions openly admit to funding these terrorists. This is a clear case of the Problem-Reaction-Solution technique that has been so successful for governments and societal leaders for thousands of years.

Having A Supply Of Healthy Foods That Last Just Makes Sense (AD)

But James’ comments do not end there. “The point is,” he says, “that when I was in the course of doing this strange activity, I had an interesting set of phone numbers and references that I could go to for help when I needed it. So people in the City have known that if they want to check out anything that looks at all odd, they can come to me and I can press a few phone numbers to obtain a reference.” James does not expound upon who these contacts actually are, but they are undoubtedly very well-connected and powerful people if they can be called upon to corroborate and provide references for such internal affairs such as those being discussed by Lord James.

Yet James’ comments reveal even more secretive activity when he begins to discuss the shadowy organization, Foundation X as he calls it, that allegedly contacted him with the proposal to aid England in the payment of its debt. Undoubtedly, the stature of Foundation X ranks higher than any organization we are currently aware of. As Lord James attempted to connect Foundation X with the appropriate individuals within the House of Lords and the Bank of England he says, “I found myself between a rock and a hard place that were totally paranoid about each other, because the foundation X people have an amazing obsession with their own security. They expect to be contacted only by someone equal to head of state status or someone with an international security rating equal to the top six people in the world.

James is clearly describing some very powerful movers and shakers with tendencies toward elitism. They are obviously accustomed to being contacted by individuals very high up in the social structure and they are unappreciative when addressed by the lower stratum. Yet when members of the Bank of England and the British House of Lords are considered lower members of society, just how high do the Foundation X people go? While bloggers have suggested that the mystery organization may be the United Nations Office of International Treasury Control (UNOITC), and some have even hinted at the Vatican, Lord James has made it clear that Foundation X, whoever they may be, are “still effectively on the gold standard from back in the 1920s and that their entire currency holdings throughout the world, which were very large, were backed by bullion.” This means that “a figure for the amount of bullion that would be needed to cover their currency reserves, as claimed, which would be more than the entire value of bullion that had ever been mined in the history of the world.” According to Lord James, Foundation X is willing to loan the British government billions of pounds for projects as diverse as hospitals, schools, and crossrails.

Regardless of the final outcome of the Foundation X loan discussion, its offer has at the very least provoked an astonishing admission from a member of the British House of Lords. A government that openly admits funding terrorism, which is aimed at its own population, and then considers business deals with shadowy financial organizations without informing them should provoke widespread outrage. But, given the current state of affairs in England, it probably won’t.

Works Cited

“Conservative Peer Lord James of Blackheath: I’m a money washer, not a money launderer.” Belfastetelegraph.co.uk. November 4, 2010. http://www.belfasttelegraph.co.uk/news/local-national/northern-ireland/conservative-peer-lord-james-of-blackheath-im-a-money-washer-not-a-money-launderer-14995248.html

Brandon Turbeville is an author out of Mullins, South Carolina. He has a Bachelor’s Degree from Francis Marion University where he earned the Pee Dee Electric Scholar’s Award as an undergraduate. He has had numerous articles published dealing with a wide variety of subjects including health, economics, and civil liberties. He also the author of Codex Alimentarius – The End of Health Freedom

Growing signs of renewed debt crisis in Europelink

by Stefan Steinberg | |||||||

| |||||||

There are growing signs of a renewed debt crisis in a number of European nations, as bond yields soar to record highs and the continent’s economic growth stagnates. The heads of leading European countries took the exceptional step of using the Group of 20 meeting in Seoul to announce that the European Union had confidence in the measures undertaken by Irish leaders to address the nation’s budget deficit. At the same time, the leaders of Germany, France, Italy and the United Kingdom issued a statement declaring that the EU had no plans for an additional bailout of European nations until at least 2013. Bond yields have been driven up in part in response to calls from Germany for revamping bailout mechanisms to place a greater burden on private investors, as opposed to European governments. To calm markets, European leaders stressed on Friday that the proposed new bailout mechanism “does not apply to any outstanding debt.” The communiqué in Seoul came one day after statements from Irish government sources and the chairman of the Eurozone group of countries, Jean-Claude Juncker, denying that Ireland was preparing to apply for emergency aid from the EU. Speculation has been rife in the financial press this week that a bailout of Ireland and other stricken European countries was the only solution to their insurmountable economic problems. The yield on Irish debt has climbed to its highest level since the launch of the euro in 1999. This is despite reports that the European Central Bank has sought to intervene on Ireland’s behalf with large-scale purchases of government bonds. Major bond investors are pricing Irish debt at risk levels as high as Greek debt earlier this year, prior to the creation of a massive €440 billion emergency rescue fund by EU states. The European Financial Stability Fund (EFSF) was backed up by a further €60 billion from the European Commission and €250 billion from the IMF. The EFSF fund was agreed following a separate €110 billion bailout package for Greece in May. Market nervousness regarding Ireland’s financial status increased last week following comments by the country’s central bank governor, Patrick Honohan, who indicated that the government was preparing to turn to the IMF. The Irish government has responded to pressure from global markets with sharp attacks on the working class. It recently announced a €15 billion austerity package spread over four-years. However, there are increasing worries in financial circles that the deeply unpopular Fianna Fail-Green coalition will prove unable to implement its planned budget cuts in the face of mounting popular opposition. Commenting on Ireland’s growing financial problems, Morgan Kelly, from the University College Dublin, told the Irish Times this week: “The next act of the crisis will rehearse the same themes of bad loans and foreign debt, only this time as tragedy rather than farce.” The problems encountered by Ireland on international finance markets last week were mirrored by a number of other countries. In what a number of media reports described as “a spreading contagion,” the premium on the debt of three other countries—Spain, Portugal and Italy—all climbed to record levels this week. Greece’s interest rate spreads have already returned to their pre-May 2010 high, and interest premiums for Belgian bonds have also hit record levels. Economic data issued last week also showed a slowdown in economic activity. Gross domestic product for the 16 Eurozone countries rose by just 0.4 percent in the three months to September, according to the EU statistics office Eurostat. This represents a clear cooling down in economic activity compared with the 1.0 percent expansion recorded in the second quarter of this year. Overall Eurozone growth figures were inflated by above average economic growth in Germany (0.7 percent this quarter), with a number of other countries reporting either stagnation or even economic decline. On Thursday, the Spanish statistics office reported that the economy had seen no growth in the third quarter. A number of the austerity measures introduced by the Socialist Party government earlier this year still have to take affect, meaning that continuing stagnation of the economy, or even a fall in economic output, is likely in the near future. Spain is one of the important markets for neighbouring Portugal, and the ongoing crisis across the border has worsened Portugal’s own chances of overcoming its budget deficit. Portugal’s deficit is the fourth largest in the EU, behind Ireland, Greece and Spain. The Socialist Party led government in Portugal recently passed a budget involving a 5 percent cut in the wage bill for public-sector workers earning more than €1,500 a month, a freeze on all new jobs and a 2 percentage point increase in value-added tax (to a total of 23 percent). Despite theses measures, the broadest program of spending cuts introduced in the country since 1978, the Portuguese Finance Ministry announced this week that it expects the country’s public debt as a percentage of GDP to actually increase next year. As for Greece, Prime Minister George Papandreou acknowledged at the start of this week that his government is unlikely to meet its public deficit targets for this year despite the draconian austerity measures introduced by his government. These developments confirm the systemic nature of the current crisis confronting the continent. A recent report issued by the Royal Bank of Scotland refers to the dangers facing Europe as a whole as a result of the plight of Ireland, Greece and Portugal: “With three countries in the euro area now having virtually lost access to capital markets, the implications for the region as a whole could easily become systemic again.” Attention now turns to the regular monthly meeting of Eurozone finance ministers next Tuesday in Brussels, where once again the situation of peripheral European countries will top the agenda. The rapidly developing European economic crisis is the consequence of a deliberate policy on the part of the European political elite to ensure that the broad masses of the population pay the price for the massive bail-out of the banks following the crash of 2008. Having poured hundreds of billions of euros into the vaults of the banks, European governments are now in the process of imposing vicious austerity policies across the continent, plunging millions into unemployment and poverty. These austerity measures have intensified the existing economic imbalances within Europe and now threaten to plunge entire countries into bankruptcy. Despite the catastrophic results of these policies, European Union leaders have stressed their determination to press ahead in the face of popular opposition. Speaking in Berlin on November 9, EU Council President Herman Van Rompuy praised the “courage” of EU leaders: “I, for one, have really been impressed over the last year by the political courage of our governments. All are taking deeply unpopular measures to reform the economy and their budgets, moreover, at a time of rising populism. “Some heads of government do this while being confronted with opposition in parliament, with protest in the streets, with strikes on the workplace—or all of this together—and fully knowing they run a big risk of electoral defeat,” he concluded. “And yet they push ahead. If this is not political courage, what is?” | |||||||

Sea Ice News #29link

In sea ice news this week, Arctic sea ice continues its inexorable climb toward the summit, to be reached sometime in March 2011. At present the ice growth is tracking just below the rate of 2007, but it should also be pointed out that according to JAXA’s AMSRE plot, we are still slightly ahead of this date last year.

The magnified view below shows just how close together all the past years are in the “choke point”:

2010 is just between 2007 and 2009 at present, and all three traces have a “knee bend” at this point, though 2010 is sharper.

Current data for JAXA:

10,31,2010,8075000 11,01,2010,8240938 11,02,2010,8403594 11,03,2010,8500000 11,04,2010,8621875 11,05,2010,8672500 11,06,2010,8693438 11,07,2010,8800781 11,08,2010,8908906 11,09,2010,8987031 11,10,2010,9056406 11,11,2010,9117656 11,12,2010,9164375 11,13,2010,9172969 11,14,2010,9183594Over 1 million square kilometers of sea ice extent has been added in the past 15 days.

NSIDC’s plot shows 2010 compared to 2007, but has 5 day smoothing, so the knee bend is not visible.

But the NANSEN plot shows these bends clearly:

Overall, nearly the entire Arctic ocean is well filled with sea ice at this point. Only the Barents and Chukchi seas have ice free areas:

Temperature within 80°N is slightly below normal at present, thought= nothing out of the ordinary variance:

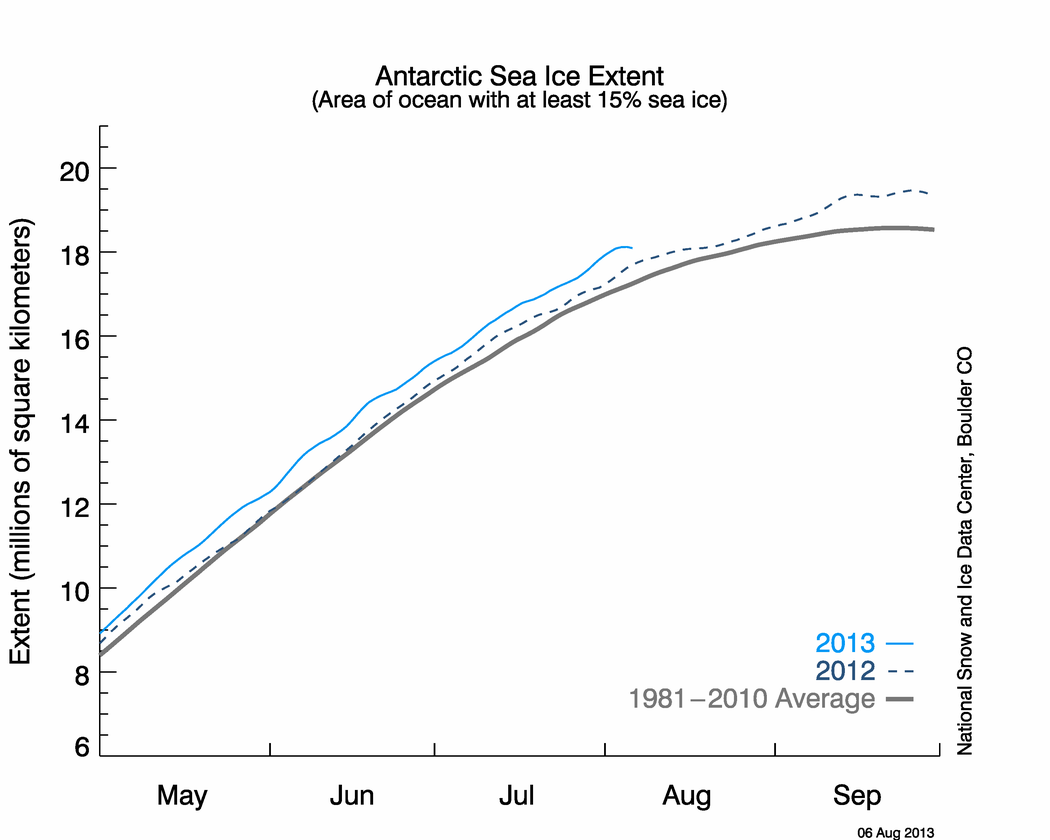

Antarctic sea ice extent remains above normal:

Floods kill more in France, Belgiumlink

GRANVILLE, France, Nov. 14 (UPI) -- Heavy rains flooded the center of a town in northern France Sunday, and more was forecast, a weather service said.Part of the seaside town of Granville was flooded Sunday morning, with water entering houses and shops, after 2 inches of rain fell on the region within 24 hours, Radio France Internationale reported.

In nearby Belgium, two people died Saturday night and another Sunday afternoon in the storm.

One 72-year-old woman was trapped by floodwaters in a car in the village of Solre-Saint-Gery, near the French frontier.

A man's body was found in the same village. He had apparently been carried away by the flood.

On Sunday afternoon another body was fished out of the water in nearby Lessines, where another person was reported missing.

In a week of storms in the north and east of France, one person has died and another was missing.

Greece's budget deficit worsenslink

Greece's austerity measures have sparked anger in the country

Greece's austerity measures have sparked anger in the country Greece's 2009 budget deficit was worse than previously calculated, making it the largest in the eurozone, new figures have shown.

The country's deficit last year stood at 15.4% of its annual economic output, said Eurostat, the European Union's statistics office.This is higher than the 13.6% figure reported in April.

Due to the revision, Greece said its 2010 deficit would only be cut to 9.4%, not its earlier target of 7.8%.

It comes as Athens is continuing efforts to reduce the deficit through austerity measures that have sparked protests from workers.

The Greek government is also being visited by EU and International Monetary Fund officials on Monday, who will decide whether to release more funds.

Greece is seeking the third part of its 110bn euros ($150bn; £93bn) aid deal, which was arranged in May.

Continue reading the main story

European deficit and debt levels 2009 | ||

|---|---|---|

| Deficit (% of GDP) | Debt (% of GDP) | |

| Source: Eurostat | ||

| Greece | -15.4 | 126.8 |

| Ireland | -14.4 | 65.5 |

| UK | -11.4 | 68.2 |

| Spain | -11.1 | 53.2 |

| Portugal | -9.3 | 76.1 |

| Germany | -3 | 73.4 |

Prime Minister George Papandreou said over the weekend that Greece might be forced to ask for an extension to the time before it has to start repaying aid money.

The Greek government said Eurostat had revised up the 2009 deficit figure for three main reasons; a downward revision of the country's economic growth rate that year, an adjustment of social security funds, and by adding data from certain public sector bodies into the general government figures.As a result, its 2009 deficit of 15.4% overtook the Republic of Ireland's 14.4% figure, which was previously calculated as the worst.

Eurostat also revised upwards the total level of Greece's debts in 2009 to 126.8% of its GDP from 115.1% previously. It predicts the country's debs will hit 1445 this year.

The European statistics office had been concerned that its earlier 2009 deficit figure for Greece had been incorrect. Its new final is its final calculation, and it said it no longer had any reservations.

Greece's Ministry of Finance said: "The revision and validation of the fiscal data up to 2009 is a major step to restore transparency in fiscal management, and to eliminate controversies over the quality and the accuracy of Greek fiscal statistics."

Eurostat said last week that Greek economy had contracted by -1.1% between July and September, better than the -1.7% decline from April to June

Ireland Goes Bust, Irish Bank Run ~ link ~ There was a bank run in Ireland on Wednesday. LCH Clearnet, a London based clearinghouse, surprised the markets by announcing it would increase margin requirements on Irish debt by 15 percent. That's all it took to send investors fleeing for the exits.

Yields on Irish bonds spiked sharply as banks tried to close positions or raise the capital needed to meet the new requirements. The Irish 10-year bond soared to 8.9 percent by day's end, more than 6 percentage points higher than "risk free" German sovereign debt. The ECB will have to intervene. Ireland is on its way to default. This is what a 21st century bank run looks like. Terms suddenly change in the repo market, where banks get their funding, and the whole system begins to teeter.

It's a structural problem in the so-called shadow banking system for which there's no remedy. Conventional banks exchange bonds with shadow banks for short-term loans agreeing to repurchase (repo) them at a later date. But when investors get nervous about the solvency of the bank, the collateral gets a haircut which makes it more expensive to fund operations. That sends bond yields skyrocketing increasing the liklihood of default. In this case, the debt-overhang from a burst development bubble is bearing down on the Irish government threatening to bankrupt the country. Ireland is in dire straights. Here's an excerpt from an article in this week's Irish Times which sums it up:

"Until September, Ireland had the legal option of terminating the bank guarantee on the grounds that three of the guaranteed banks had withheld material information about their solvency, in direct breach of the 1971 Central Bank Act. The way would then have been open to pass legislation along the lines of the UK’s Bank Resolution Regime, to turn the roughly €75 billion of outstanding bank debt into shares in those banks, and so end the banking crisis at a stroke.

With the €55 billion repaid, the possibility of resolving the bank crisis by sharing costs with the bondholders is now water under the bridge. Instead of the unpleasant showdown with the European Central Bank that a bank resolution would have entailed, everyone is a winner. Or everyone who matters, at least." ("If you thought the bank bailout was bad, wait until the mortgage defaults hit home", Morgan Kelley, Irish Times)

So, the Irish government could have let the bankers and bondholders suffer the losses, but decided to bail them out and pass the debts along to the taxpayers instead. Sound familiar? Only, in this case, the obligations exceed the country's ability to pay. Austerity measures alone will not fix the problem. Eventually, the debt will have to be restructured and the losses written down. Here's another clip from Kelly's article:

"As a taxpayer, what does a bailout bill of €70 billion mean? It means that every cent of income tax that you pay for the next two to three years will go to repay Anglo’s (bank) losses, every cent for the following two years will go on AIB, and every cent for the next year and a half on the others. In other words, the Irish State is insolvent: its liabilities far exceed any realistic means of repaying them....

Ireland's young flee abroad as economic meltdown looms ~ link ~ People's lives all over the world are being destroyed by the same tiny super-elite satanists, the Global Banking Families. Wake up people. Stirling

Mark Ward, president of Tallaght's student union, says that 1,250 students are leaving Ireland every month. One in five graduates is seeking work outside the country. The Union of Students in Ireland believes that 150,000 students will emigrate in the next five years.

Next month the government will deliver its latest austerity budget with the aim of slashing a further €15bn from public spending on top of the €14.5bn it has already been forced to cut. But Kelly has argued that the public sector cuts are "an exercise in futility" when compared with the €70bn bill for Ireland's bad banks. "What is the point of rearranging the spending deckchairs, when the iceberg of bank losses is going to sink us anyway?" he asked in the Irish Times last week.

Put at its starkest, for the next six to seven years, every cent of income tax paid by Irish citizens will go to cover the banks' losses.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.